Headquartered in Charlotte, North Carolina, Albemarle Corporation (ALB) is a global supplier of energy storage and specialty chemical solutions. With a market capitalization of about $15.6 billion, Albemarle sits above the $10 billion threshold, holding “large-cap” stature.

This scale allows the company to supply lithium compounds, bromine chemicals, catalysts, and advanced materials across batteries, mobility, clean fuels, electronics, pharmaceuticals, and industrial markets.

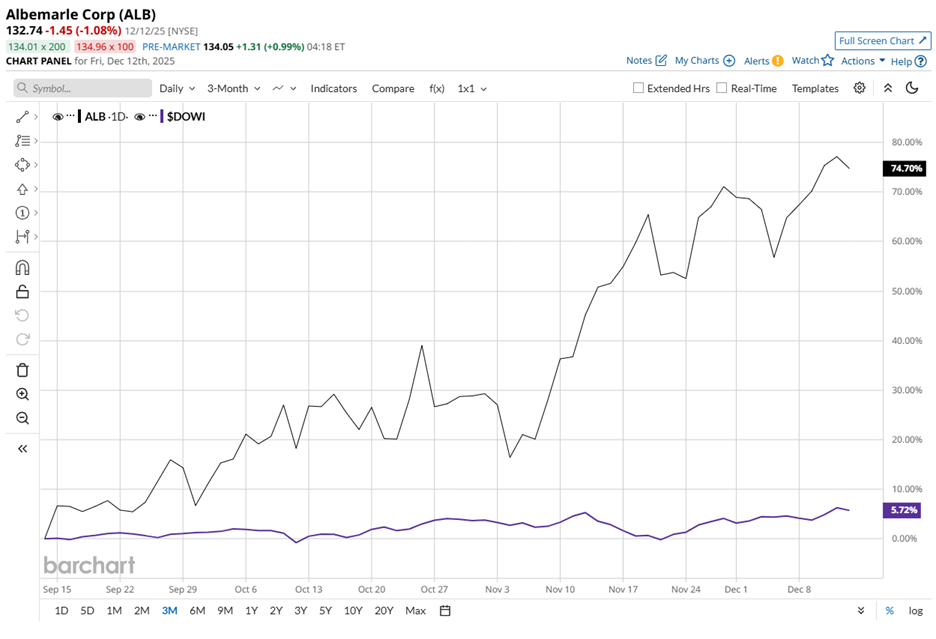

ALB shares currently trade just 2.5% below their December high of $136.10 and have surged 74.7% over the past three months. The rally decisively eclipses the Dow Jones Industrial Average’s (DOWI) 5.7% gain, signaling strong investor conviction.

Looking further out, ALB stock has advanced 28.5% over the past 52 weeks and climbed 54.2% year-to-date (YTD). Over the same periods, the Dow rose only 10.4% and 13.9%, respectively, reinforcing ALB's sustained outperformance and strengthening its relative appeal.

The technical picture supports the optimism. Since mid-Sept, ALB stock has been trading consistently above its 50-day moving average of $107.79 and its 200-day moving average of $79.10.

On Nov 5, the stock added another 4% after Albemarle delivered better-than-expected Q3 fiscal 2025 results. Revenue declined 3.5% year over year to $1.31 billion but exceeded Street estimates of $1.29 billion. Adjusted loss per share narrowed 87.7% year over year to $0.19, significantly beating expectations for a $0.92 loss per share.

Management reinforced confidence by enhancing its fiscal year 2025 outlook. They expect enterprise results toward the higher end of the previously published $9/kg scenario range, supported by year-to-date performance, lithium pricing trends, and stronger-than-expected Energy Storage volume growth.

The company is also targeting a positive free cash flow of $300–$400 million in 2025, strengthening balance-sheet resilience.

To put ALB’s outperformance into perspective, its Rival Bristol-Myers Squibb Company (BMY) has fallen 6.9% over the past 52 weeks and dropped 7.4% year-to-date, making Albemarle’s trajectory stand out even more.

Analysts continue to lean positive on the stock. Among 26 analysts, the consensus rating stands at “Moderate Buy,” and ALB stock is already trading above the average price target of $112.50.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart