News

Explore how SCHQ’s government focus and SPLB’s corporate breadth shape risk profiles and income potential for long-term bond investors.

Via The Motley Fool · February 10, 2026

These exchange-traded funds invest in some of the best growth stocks in the world.

Via The Motley Fool · February 10, 2026

The Vanguard Consumer Staples ETF and the Invesco Food & Beverage ETF both promise defensive exposure, but they approach it through different strategies. This comparison explains how those design choices affect cost and the kind of stability investors can realistically expect.

Via The Motley Fool · February 10, 2026

Amazon's post-earnings pullback resulted in a big slide for this geared ETF, reminding investors of the risks associated with these funds.

Via The Motley Fool · February 10, 2026

Ethereum tests $2,000 support after sharp selloff as ETF inflows rise, with $2,400 recovery and breakdown risks in focus.

Via Talk Markets · February 10, 2026

My proprietary ROAR score acts akin to Polymarket or Kalshi. It’s showing the odds of an up move in the S&P 500 are lower than the odds of a down move coming next.

Via Barchart.com · February 10, 2026

With small-cap value stocks roaring back to life, this outperforming ETF is ready for its close-up.

Via The Motley Fool · February 10, 2026

Coca-Cola's earnings highlight shifting demand trends: Investors focus on consumer staples ETFs and reassess defensive-sector opportunities.

Via Benzinga · February 10, 2026

The Vanguard High Dividend Yield ETF and the Schwab U.S. Dividend Equity ETF both aim to deliver reliable income, but they go about it in very different ways. This comparison explains which approach is better suited for investors who depend on their dividends to hold steady through changing markets.

Via The Motley Fool · February 10, 2026

It's time to nip these issues in the bud.

Via The Motley Fool · February 10, 2026

As per the data from Bloomberg Intelligence, equity turnover averaged a record $1.03 trillion in January, a roughly 50% increase from the same period in 2025.

Via Stocktwits · February 10, 2026

Though Caterpillar has outperformed relative to the broader market over the past year, Wall Street analysts maintain a cautiously optimistic outlook on the stock’s prospects.

Via Barchart.com · February 10, 2026

The ETF's returns have been flat this year, as growth stocks have been struggling of late.

Via The Motley Fool · February 10, 2026

The iShares Core High Dividend ETF is up 12% this year.

Via The Motley Fool · February 10, 2026

The tech stock has been falling, despite posting another strong quarter.

Via The Motley Fool · February 10, 2026

These funds both pay more than 3% and have been beating the market this year.

Via The Motley Fool · February 10, 2026

Principal (PFG) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 10, 2026

The Japanese stock market reached a historic milestone on February 10, 2026, as the Nikkei 225 index surged to an all-time high of 58,000, capping a spectacular rally that has fundamentally redefined Japan’s position in the global financial landscape. This surge, fueled by a landslide victory for the

Via MarketMinute · February 10, 2026

While Sherwin-Williams has underperformed relative to the broader market over the past year, Wall Street analysts maintain a moderately optimistic outlook on the stock’s prospects.

Via Barchart.com · February 10, 2026

The benchmark 10-year U.S. Treasury yield plummeted to 4.14% on Tuesday, February 10, 2026, as investors aggressively repositioned for a more dovish Federal Reserve following a starkly disappointing retail sales report. The move represents a significant departure from the 4.30% levels seen earlier this year, signaling that

Via MarketMinute · February 10, 2026

As Clorox has underperformed the broader market over the past year, Wall Street analysts maintain a cautious outlook about the stock’s prospects.

Via Barchart.com · February 10, 2026

Explore how expense structure and portfolio concentration set these two short-term bond ETFs apart for conservative investors.

Via The Motley Fool · February 10, 2026

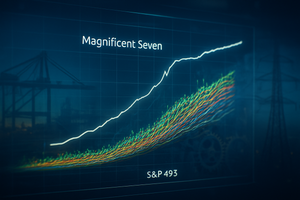

As of February 10, 2026, the long-standing "two-speed" economy that defined the post-pandemic era has finally reached a historic turning point. For years, a handful of mega-cap technology titans—the "Magnificent Seven"—carried the weight of the entire U.S. stock market on their shoulders, while the remaining 493 companies

Via MarketMinute · February 10, 2026

Virtus adds a new Emerging Market Dividend ETF to its roster days before its Q4 results showed ETF growth despite equity outflows.

Via Benzinga · February 10, 2026

Smaller stocks and value equities are displaying leadership traits, indicating investors may want to allocate $1,000 (or more) to this Vanguard ETF.

Via The Motley Fool · February 10, 2026