Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

Japan will release key growth data next week, including GDP and exports.

Via Talk Markets · February 13, 2026

Although the benchmark indices opened lower, they traded negatively throughout the session and ultimately closed red.

Via Talk Markets · February 13, 2026

Inflation is always in the background for those of us who follow metals. But lately, with the dollar weakening and both stocks and hard assets rising together, it feels worth revisiting a simple question.

Via Talk Markets · February 13, 2026

The Payrolls Employment Report in the United States released earlier this week was stronger than expected.

Via Talk Markets · February 13, 2026

IBIT is very large, extremely liquid, and down substantially in 2026. I bought the dip and sold profitably. I explain why I have my eyes on IBIT.

Via Talk Markets · February 13, 2026

The US dollar is firm against the G10 currencies ahead of the US January CPI.

Via Talk Markets · February 13, 2026

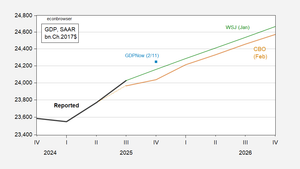

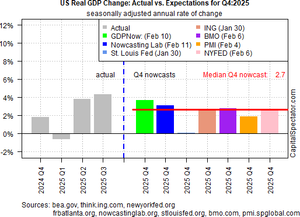

GDPNow shows fast growth.

Via Talk Markets · February 13, 2026

Silver collapsed by nearly 10% to below $76 per ounce, continuing a sharp reversal amid broad liquidation of positions across financial markets.

Via Talk Markets · February 13, 2026

The Federal Reserve put interest rate cuts on pause at the January meeting. The central bankers cited expanding economic activity and a stable labor market as reasons for the pause.

Via Talk Markets · February 13, 2026

EUR/USD claws back part of its earlier losses after soft US CPI data weighs on the Greenback.

Via Talk Markets · February 13, 2026

Headline consumer price inflation came in cooler than expected in January (+0.2% MoM vs +0.3% expected).

Via Talk Markets · February 13, 2026

Recession risk remains low, but the torrid pace of GDP growth in recent quarters is expected to downshift in next week’s delayed fourth-quarter report from the government.

Via Talk Markets · February 13, 2026

Following the “Dot.com crash,” many individuals learned the perils of “risk” and “leverage.” Unfortunately, for Gen-Z’ers, such is a lesson that is still waiting to be learned.

Via Talk Markets · February 13, 2026

SCHW dropped roughly 15% in a sharp move lower that caught many traders off guard.

Via Talk Markets · February 13, 2026

Existing home sales utterly crashed in January.

Via Talk Markets · February 13, 2026

Google’s parent, Alphabet, just issued $32 billion in global debt, including £1 billion of rare century bonds.

Via Talk Markets · February 13, 2026

The euro continues its struggles against the yen as the pair hits lower lows.

Via Talk Markets · February 13, 2026

Rivian shares jumped about 20% in premarket trading after the EV maker beat Q4 expectations and reaffirmed its R2 launch timeline.

Via Talk Markets · February 13, 2026

We are seeing a cautious tone in Europe, following on from the jitters seen throughout US and Asia.

Via Talk Markets · February 13, 2026

Poland’s January CPI inflation surprised to the upside due to technical quirks and volatile prices.

Via Talk Markets · February 13, 2026

Themes of rotation out of large cap US growth stocks and into small cap and/or value stocks and/or international stocks continue to dominate market commentary.

Via Talk Markets · February 13, 2026

Markets across a broad spectrum of asset classes faced sharp declines as concerns surrounding tech sector earnings and commodity weakness weighed heavily on equities.

Via Talk Markets · February 13, 2026

EUR/USD ended the week at 1.1868, remaining within a narrow sideways range for the fourth consecutive session.

Via Talk Markets · February 13, 2026

The market is bracing for a highly volatile CPI Friday. After a significant

Via Talk Markets · February 12, 2026

Via Talk Markets · February 12, 2026

The major European stock markets had a mixed day today.

Via Talk Markets · February 12, 2026

Coya Therapeutics is advancing a promising ALS treatment with financial support from partner Dr. Reddy's and investors like Greenlight Capital.

Via Talk Markets · February 13, 2026

The dollar is once again softer this week, keeping the Euro relatively elevated.

Via Talk Markets · February 13, 2026

Citizens Financial is one of the largest retail bank holding companies in the United States.

Via Talk Markets · February 13, 2026

EUR/USD is hovering near 1.1855 after retreating from weekly highs at 1.1928.

Via Talk Markets · February 13, 2026

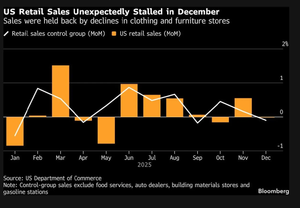

The start of 2026 no longer looks like a simple cyclical slowdown.

Via Talk Markets · February 13, 2026

WTI crude oil continues to trade within a tight range, with $66 acting as resistance and $62 as support, as traders await clarity on geopolitical and supply dynamics.

Via Talk Markets · February 13, 2026

Via Talk Markets · February 12, 2026

Even with the data being heavily revised, the uptrend in employment is observable. The trend in these data sets is always more important than the actual count.

Via Talk Markets · February 12, 2026

Global markets open focused on today’s US CPI as softer inflation would cement Fed dovishness, pressure the dollar, and contrast with hawkish signals from Japan and Australia.

Via Talk Markets · February 13, 2026

Indian share markets are trading lower with the Sensex trading 682 points lower, and the Nifty is trading 214 points lower.

Via Talk Markets · February 13, 2026

The tech selloff appears to be offering the dollar some support, suggesting that a degree of safe‑haven value has been restored.

Via Talk Markets · February 13, 2026

West Texas Intermediate (WTI), the US crude oil benchmark, is trading around $62.50 during the early European trading hours on Friday. The WTI price attracts some sellers amid persistent oversupply concerns.

Via Talk Markets · February 13, 2026

USD/INR appreciates as the Indian Rupee (INR) weakens amid broad risk-off sentiment and softness in Asian currencies.

Via Talk Markets · February 13, 2026

Gold (XAU/USD) regains positive traction during the Asian session on Friday and recovers a part of the previous day's heavy losses to the $4,878-4,877 region, or the weekly low.

Via Talk Markets · February 13, 2026

In this post, I will walk you through what I am seeing on the charts, including the head and shoulders breakdown that confirmed in January and the bear flag forming now.

Via Talk Markets · February 13, 2026

The Nasdaq‑100 Index ETF has completed the cycle that began from the April 7, 2025 low, and the instrument is now entering a larger‑degree corrective phase.

Via Talk Markets · February 13, 2026

Hong Kong stocks came under pressure on Friday, with the Hang Seng Index falling for the second consecutive day, reaching its lowest level since February 6 this year.

Via Talk Markets · February 13, 2026

Stocks gave up early gains as AI-related uncertainty and weak economic signals triggered a sell-off, with major indexes sliding and investors reassessing how AI might impact the broader economy and markets.

Via Talk Markets · February 12, 2026

This article examines how revised economic benchmarks reshape the interpretation of “Liberation Day” data, showing that post-benchmark figures, notably for August, appear even weaker than before.

Via Talk Markets · February 12, 2026

As with last week, I had a couple of fantastic back-to-back days. Each of them started off looking bad, then as the day wore on, it just got better and better. I can only hope that it doesn’t all get undone with some mega-rally on Friday.

Via Talk Markets · February 12, 2026

Microsoft AI CEO Mustafa Suleyman forecasted that within the next two years desk-bound tasks will be swallowed by AI.

Meanwhile, Anthropic is warning that their latest Claude models could be used for

Via Talk Markets · February 12, 2026

Pure‑play cybersecurity software stocks are down YTD because the market narrative has shifted against them, even as fundamentals remain intact. The YTD drawdown is a valuation and positioning story, not a fundamentals story.

Via Talk Markets · February 12, 2026

Last year wasn’t an easy one for The Trade Desk Inc. But with the shares recently below $40, the risk/reward looks far different than when the stock traded above $140

Via Talk Markets · February 12, 2026

In this video, Ira Epstein discusses the significant downturn in the stock market on February 12, 2026, highlighting a notable drop in Apple shares despite the company not being directly involved in AI software issues.

Via Talk Markets · February 12, 2026

What started off as a relatively benign day in the gold and silver markets has turned into another bloodbath, which we’re also seeing in the other markets as well. Although once again, silver’s decline is substantially larger.

Via Talk Markets · February 12, 2026

The Australian Dollar advances against the US Dollar on Friday after posting losses of more than 0.5% in the previous session.

Via Talk Markets · February 12, 2026

The USD/JPY pair gains some positive traction during the Asian session on Friday and moves away from an over two-week low, around the 152.30-152.25 region, touched the previous day.

Via Talk Markets · February 12, 2026

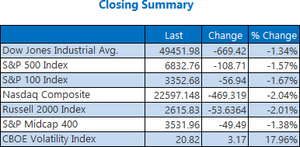

Stocks fell sharply today, with the S&P 500 dropping nearly 1.6% and the Nasdaq 100 declining more than 2%. Today was also a settlement day, with $22 billion settling, so the sell-off wasn’t particularly surprising.

Via Talk Markets · February 12, 2026

The S&P 500 down 1.3% is just the beginning.

Via Talk Markets · February 12, 2026

AI will make most of us poorer and a few fabulously wealthy — unless its productivity gains are allocated fairly. Here’s what we should we be considering now.

Via Talk Markets · February 12, 2026

AUD/USD backslid around 0.5% on Thursday.

Via Talk Markets · February 12, 2026

Silver squeeze narratives dominate retail thinking, but bullion bank strategy tells a different story. We break down the silver shorts narrative, bullion bank positioning, and their role in market structure.

Via Talk Markets · February 12, 2026

The Nasdaq fell 469 points, marking its third-straight session in the red alongside the S&P 500.

Via Talk Markets · February 12, 2026

Expeditors International and C.H. Robinson Worldwide both erased six months of gains on volume that dwarfs everything we've seen all year. That kind of selling doesn't happen in a vacuum.

Via Talk Markets · February 12, 2026

Minto Apartment Real Estate Investment Trust is a monthly dividend stock with a high yield. This potentially makes the stock more attractive for income investors looking for more frequent dividend payouts.

Via Talk Markets · February 12, 2026

The federal government ran a $94.62 billion deficit in January, according to the monthly Treasury statement. That was down 26 percent compared to January 2025.

Via Talk Markets · February 12, 2026

Europe’s answer to geopolitical shifts, the emergence of China as a systemic rival, and its own lack of strategic autonomy is encapsulated in the initiative “One Europe, one market”, which is expected to be completed by the end of 2027.

Via Talk Markets · February 12, 2026

The S&P High Yield Dividend Aristocrats (S&P HYDA) includes large-, mid- and small-cap U.S. companies that have consistently raised their dividends for at least 20 consecutive years.

Via Talk Markets · February 12, 2026

The NAR blames the weather for an 8.4 percent plunge.

Via Talk Markets · February 12, 2026

Bitcoin futures show increasing bearish pressure, with a potential drop to $60K as liquidity gaps grow and momentum weakens.

Via Talk Markets · February 12, 2026

Ho Hum. Another beat-and-raise quarter from the global leader in prestige beauty.

Via Talk Markets · February 12, 2026

We discuss what the screen is not showing: the mechanics of silver settlement and why COMEX delivery behaviour into March is drawing so much attention.

Via Talk Markets · February 12, 2026

Although Datadog is seeing accelerating growth and platform expansion in key areas, risks remain in its still-lofty valuation – even after the recent decline – and meaningful customer concentration with its largest account.

Via Talk Markets · February 12, 2026

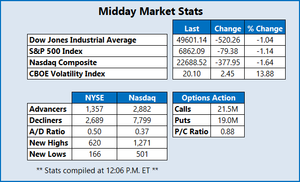

Stocks have pared solid opens and are sharply lower midday, as investors continued to rotate out of tech.

Via Talk Markets · February 12, 2026

Nvidia stock moved higher in early trading on Thursday, with the chipmaker once again testing the upper end of its recent range as investors positioned ahead of its earnings report later this month.

Via Talk Markets · February 12, 2026

The Federal Reserve (Fed) held rates at 3.50% to 3.75% at its January 28 meeting, pausing after three consecutive quarter-point cuts in 2025.

Via Talk Markets · February 12, 2026

The rapid buildout of AI infrastructure is increasing demand for reliable power, and that reality could strengthen the role of natural gas and other dispatchable energy sources for many years.

Via Talk Markets · February 12, 2026