Leonardo DRS has had an impressive run over the past six months. While the S&P 500 has been flat, the stock has returned 23.1% and now trades at $34.97. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Leonardo DRS, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

We’re happy investors have made money, but we're swiping left on Leonardo DRS for now. Here are three reasons why we avoid DRS and a stock we'd rather own.

Why Is Leonardo DRS Not Exciting?

Developing submarine detection systems for the U.S. Navy, Leonardo DRS (NASDAQ:DRS) is a provider of defense systems, electronics, and military support services.

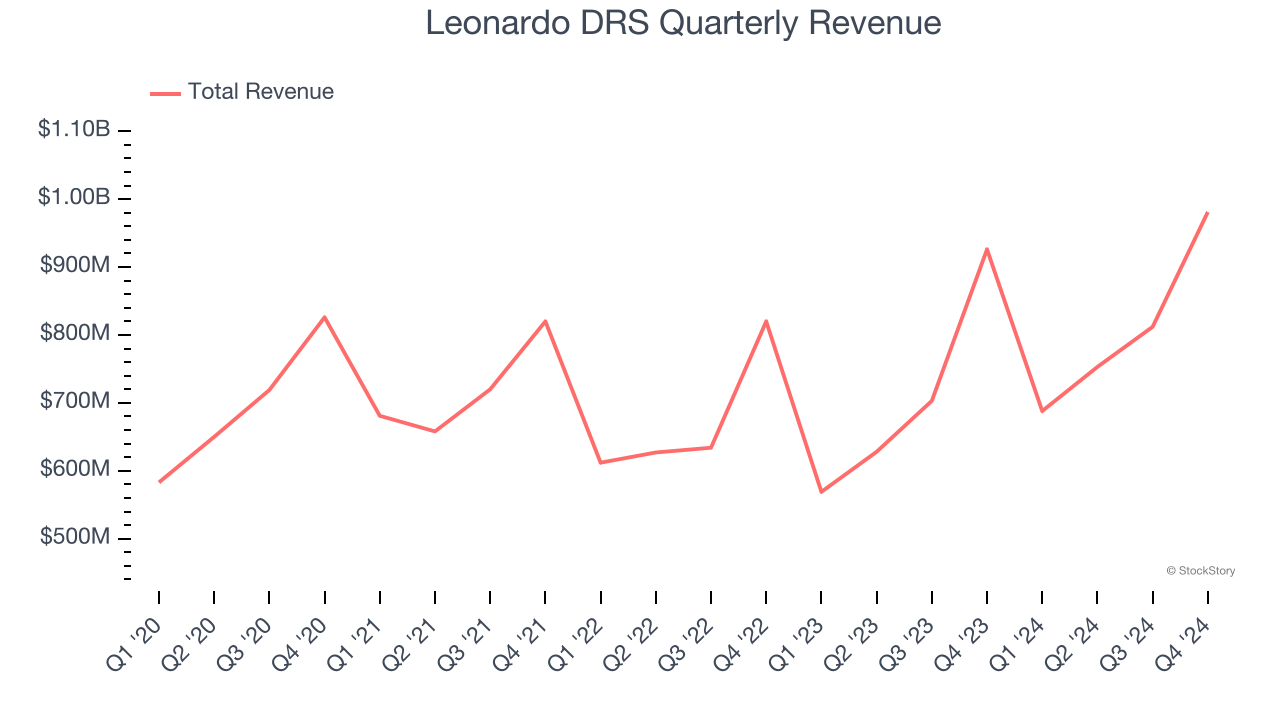

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Leonardo DRS’s sales grew at a sluggish 3.9% compounded annual growth rate over the last four years. This fell short of our benchmark for the industrials sector.

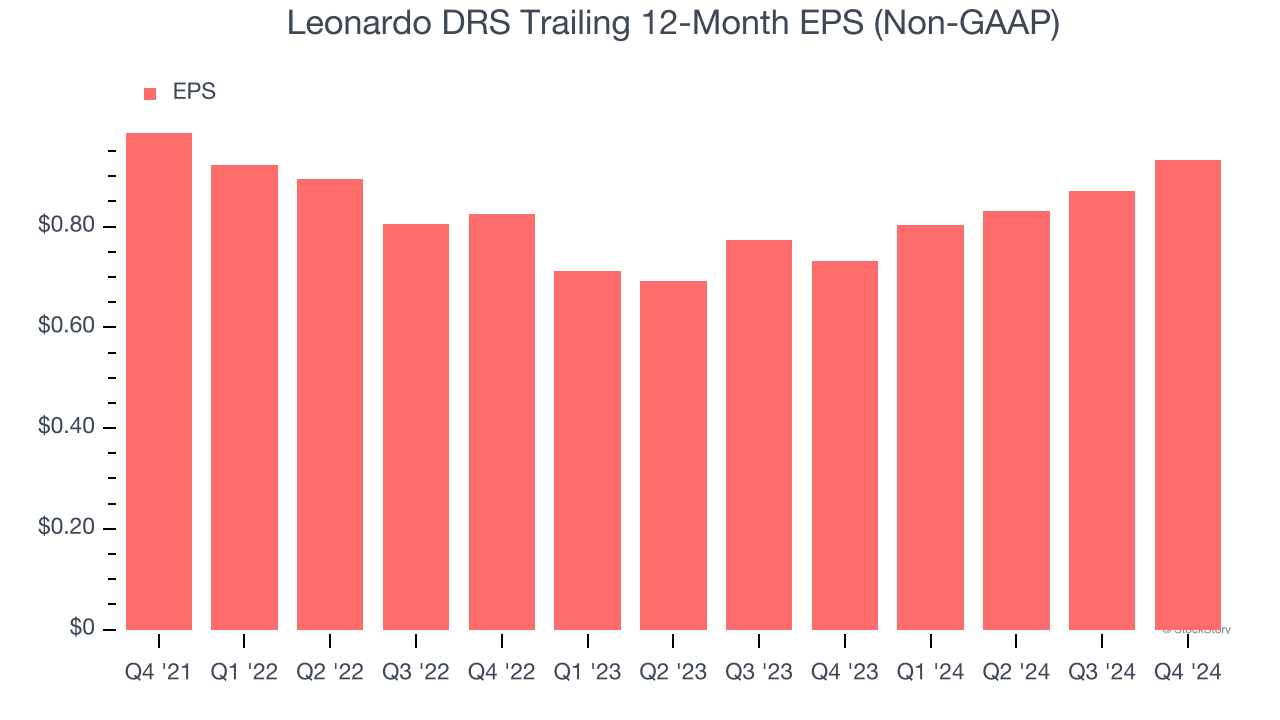

2. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Leonardo DRS’s full-year EPS dropped 5.5%, or 1.8% annually, over the last three years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Leonardo DRS’s low margin of safety could leave its stock price susceptible to large downswings.

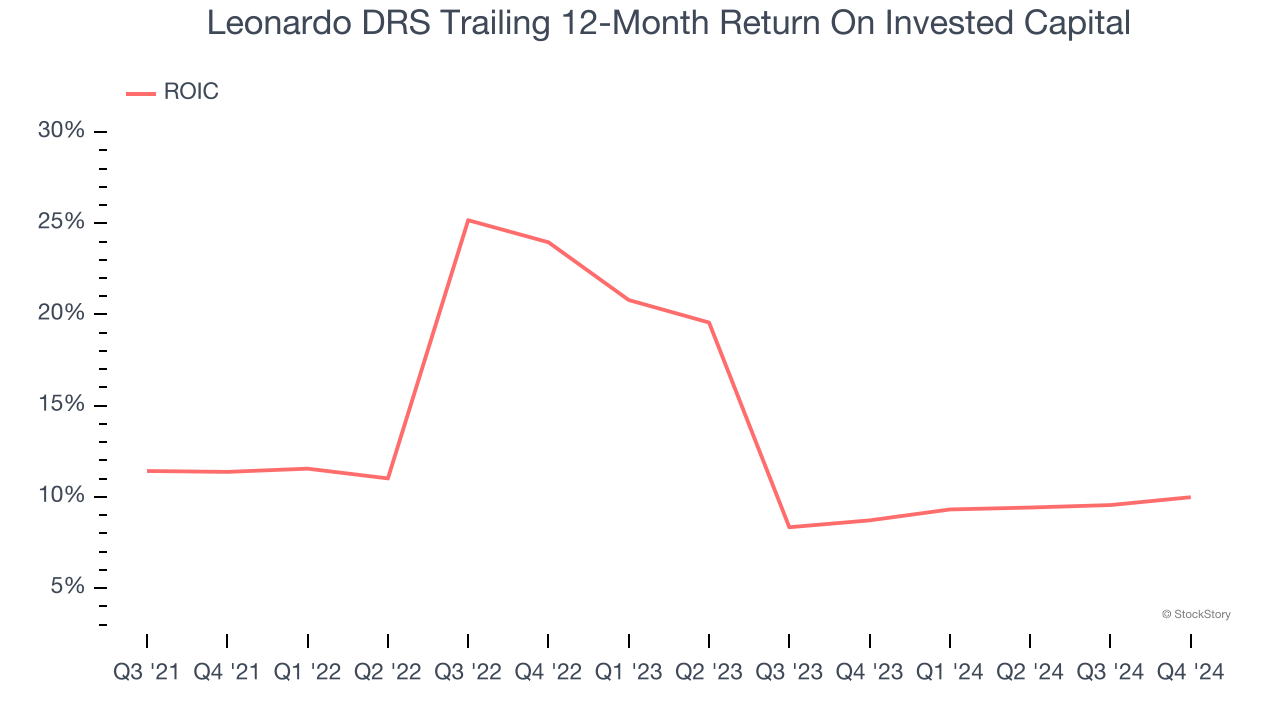

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Leonardo DRS’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Leonardo DRS isn’t a terrible business, but it doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 32.8× forward price-to-earnings (or $34.97 per share). At this valuation, there’s a lot of good news priced in - you can find better investment opportunities elsewhere. We’d recommend looking at one of our top digital advertising picks.

Stocks We Like More Than Leonardo DRS

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.