BellRing Brands’s stock price has taken a beating over the past six months, shedding 53.6% of its value and falling to $25.75 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in BellRing Brands, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is BellRing Brands Not Exciting?

Even with the cheaper entry price, we're cautious about BellRing Brands. Here are three reasons we avoid BRBR and a stock we'd rather own.

1. Fewer Distribution Channels Limit its Ceiling

With $2.32 billion in revenue over the past 12 months, BellRing Brands is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect BellRing Brands’s revenue to rise by 4.1%, a deceleration versus This projection is underwhelming and indicates its products will face some demand challenges.

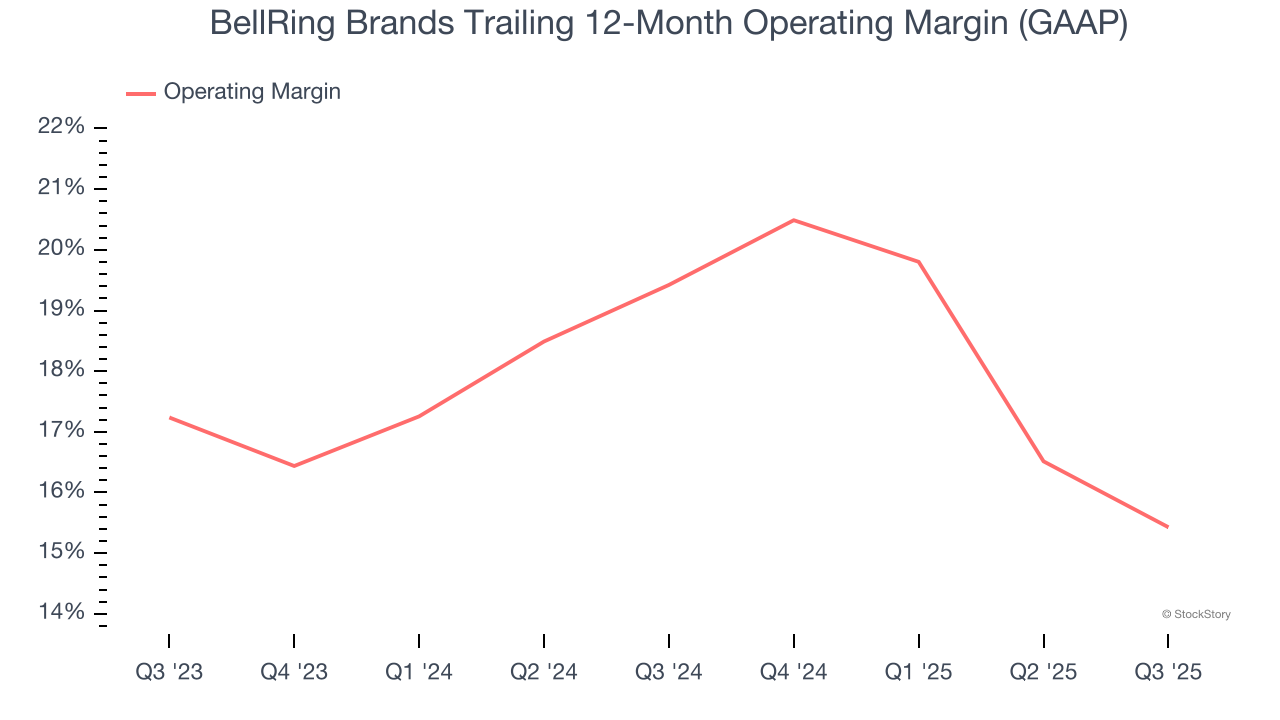

3. Shrinking Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, BellRing Brands’s operating margin decreased by 4 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 15.4%.

Final Judgment

BellRing Brands’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 14.6× forward P/E (or $25.75 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.