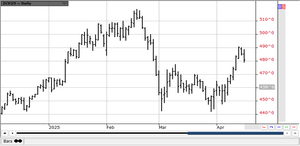

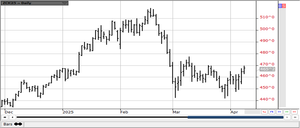

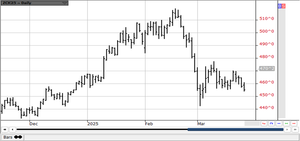

Teucrium Wheat Fund ETV (WEAT)

20.34

-0.03 (-0.15%)

NYSE · Last Trade: Jan 11th, 5:25 AM EST

Detailed Quote

| Previous Close | 20.37 |

|---|---|

| Open | 20.35 |

| Day's Range | 20.21 - 20.40 |

| 52 Week Range | 19.78 - 26.75 |

| Volume | 141,986 |

| Market Cap | 5.28M |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 147,051 |

Chart

News & Press Releases

September 2025 concluded with a stark divergence in the global commodity markets, painting a clear picture of winners and losers driven by a confluence of macroeconomic shifts, geopolitical uncertainties, and fundamental supply-demand dynamics. While precious metals staged an impressive rally, reaching multi-year and even all-time highs, the agricultural sector, particularly

Via MarketMinute · October 1, 2025

Crude oil ticked up slightly this morning as the market remains cautious amid the developing situation over trade talks between the US and China.

Via Talk Markets · April 28, 2025

Rice closed a little lower again on follow through selling.

Via Talk Markets · April 25, 2025

Cotton was higher as demand ideas got help when Mr. Trump dialed back on his tariff threats and threats on the independence of the Fed.

Via Talk Markets · April 24, 2025

May Beans have been confined to a tight 20 cent range in the past 8 trading days.

Via Talk Markets · April 23, 2025

Risk assets staged a recovery yesterday amid growing hopes for a de-escalation in US-China trade tensions. President Trump also eased concerns he might fire Federal Reserve Chair Powell.

Via Talk Markets · April 23, 2025

Gold prices surged to fresh highs amid concerns about the US Federal Reserve’s independence. Oil and other risk assets, however, are under pressure amid heightened global uncertainty.

Via Talk Markets · April 22, 2025

Rice closed lower but futures are still holding to a sideways trend.

Via Talk Markets · April 21, 2025

A creeping rotation out of U.S. assets and a subtle, but steady, rethink of the dollar as the default global parking spot.

Via Talk Markets · April 18, 2025

Remarkably, May Beans have managed to rally 90 cents (970-1050) this month despite the massive tariffs against China – as other countries have stepped up their exports.

Via Talk Markets · April 16, 2025

Rice closed higher again and are holding to a sideways to up trend.

Via Talk Markets · April 15, 2025

May Corn has displayed impressive bullish divergence – rallying 30 cents off its trading range lows – despite the tariffs.

Via Talk Markets · April 10, 2025

Rice closed higher again as the U.S. will negotiate on tariffs with all countries except China.

Via Talk Markets · April 10, 2025

Trump surprised markets with a 90-day pause in reciprocal tariffs for most trading partners. This provided a boost to risk assets, including commodities. However, there’s still plenty of uncertainty as the US again increased tariffs on China.

Via Talk Markets · April 10, 2025

Cotton was lower in a further response to the Trump tariffs that threaten to greatly increase the costs of imports from China and Vietnam among other things.

Via Talk Markets · April 9, 2025

Risk of further escalation in trade tensions between the US and China poses increased downside risks to the commodities complex.

Via Talk Markets · April 8, 2025

Wheat extended its long-term bearish cycle in February, aligning with the broader trend that has persisted since March 2022.

Via Talk Markets · April 3, 2025

For most of March, April Hogs have been locked into a tight trading range (85-88) supported by the upcoming strong “cook-out” demand period.

Via Talk Markets · April 2, 2025

Rice closed mixed yesterday, with the trade reacting to less than expected stocks but higher than expected intended area planted from USDA.

Via Talk Markets · April 2, 2025

Oil prices rose yesterday as the US threatened secondary tariffs on Russian and Iranian oil.

Via Talk Markets · April 1, 2025

Soybeans and the products closed higher, with Soybean Oil the strongest part of the complex.

Via Talk Markets · March 28, 2025

May Beans have been confined to a tight range for most of March.

Via Talk Markets · March 27, 2025

Rice closed lower, with trading slow before the USDA stocks in all positions report and the prospective plantings report coming on Monday.

Via Talk Markets · March 26, 2025

Soybeans and the products closed higher and Soybean Meal was the weakest link as basis levels remained firm in Brazil.

Via Talk Markets · March 24, 2025

Palm Oil futures were lower on what appeared to be speculative long liquidation before the weekend.

Via Talk Markets · March 21, 2025